Online Professional Tax Payment Maharashtra

Schreibprogramm windows vista kostenlos downloaden. By New computers today come with Windows Vista preinstalled — it’s practically unavoidable. If it’s running Windows 98 or Windows Me, don’t bother trying: Vista requires a powerful PC with cutting-edge parts. But, if you have an older computer, it’s time to upgrade from Windows XP to Windows Vista.

Maharashtra Profession Tax Act SCOPE Every person, engaged actively or otherwise in any profession, trade, calling or employment and falling under one or other classes mentioned in Schedule I of the Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975, is liable to pay, to the State Government, tax prescribed under the said Schedule. 3(2)] Persons earning salary or wages are also covered. Employers are required to deduct Profession Tax, at prescribed rates, from salary/wages paid to employees, and to pay the tax to State Government on behalf of employees. Employer is liable to pay tax irrespective of deduction.

Cyber Treasury for Govt. Of Chhattisgarh (VAT & Other state Commercial Taxes) Click on the Chhattisgarh Commercial Tax portal. You are displayed the Chhattisgarh state govt site for online tax. Select the applicable tax payment and fill up the required details. Select SBI for payment from the list of Banks.

4) Where any employee is covered by one or more entries other than Entry 1 in Schedule I and rate of tax under any such other entry is more than rate of tax under Entry I of that schedule and if he issues to his employer, a certificate in Form IIB, or where employee is simultaneously engaged in employment of more than one employer and if such employee issues to his employer, a certificate in Form IIC, the employer(s) has not to deduct tax from the salary/wages payable and such employer(s) are not liable to deposit tax on behalf of such employee. REGISTRATION AND ENROLMENT Section 5 — every person, liable to pay tax u/s. 4, shall obtain a Certificate of Registration, and, every person, liable to pay tax u/s. 3(2), shall obtain a Certificate of Enrolment from prescribed authority in prescribed manner. Application for enrolment/registration shall be made within 30 days from date of commencement of profession, trade, calling or employment or within 30 days of becoming liable to pay tax under the Act.

4) Where any employee is covered by one or more entries other than Entry 1 in Schedule I and rate of tax under any such other entry is more than rate of tax under Entry I of that schedule and if he issues to his employer, a certificate in Form IIB, or where employee is simultaneously engaged in employment of more than one employer and if such employee issues to his employer, a certificate in Form IIC, the employer(s) has not to deduct tax from the salary/wages payable and such employer(s) are not liable to deposit tax on behalf of such employee. REGISTRATION AND ENROLMENT Section 5 — every person, liable to pay tax u/s. 4, shall obtain a Certificate of Registration, and, every person, liable to pay tax u/s. 3(2), shall obtain a Certificate of Enrolment from prescribed authority in prescribed manner. Application for enrolment/registration shall be made within 30 days from date of commencement of profession, trade, calling or employment or within 30 days of becoming liable to pay tax under the Act.

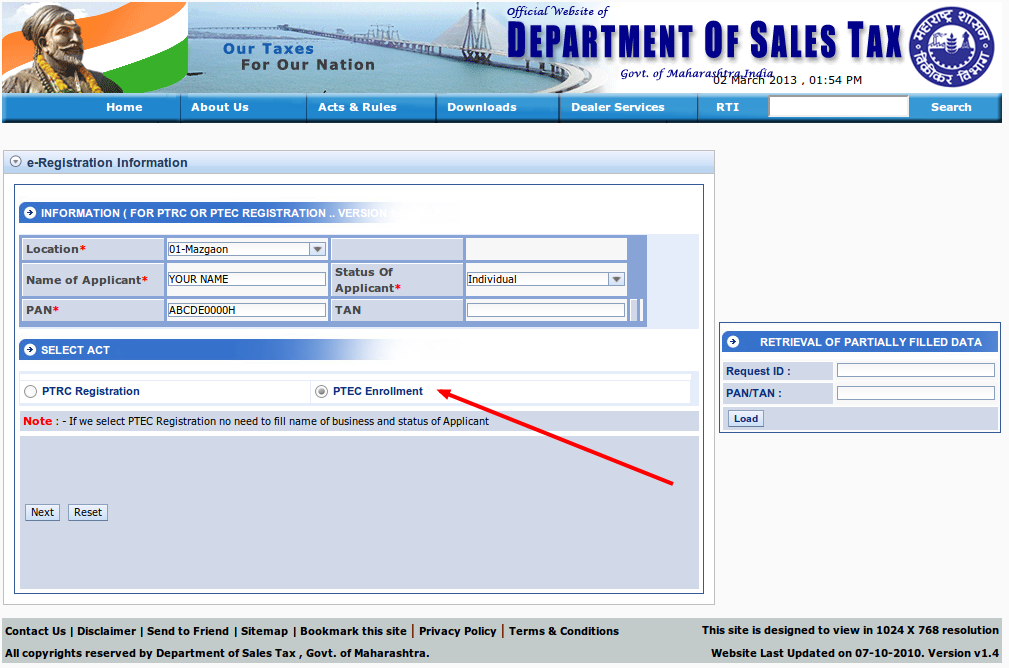

Application for enrolment and application for registration have to be made online, w.e.f. 1st April 2012, in Forms I and II respectively, (Ref.: Cir. 5T dated 31st March, 2012). The procedure for obtaining Certificate of Enrolment and Certificate of Registration under the Profession Tax Act has been further simplified by providing for a combined online application form (for MVAT, CST and PT) w.e.f.

7th May 2015. This online registration facility is available to all resident dealers/persons. On submission of correct and complete data through such online application, the TIN (Tax-payer Identification Number) will be generated by the Department within three working days and the same shall be displayed on the website of the Department. As per new procedure, the certificate of TIN can be downloaded from the website (earlier it was sent to the address of applicant by post/courier, within a month). Thus, now for profession tax enrolment/registration there is no need for personal attendance or physical submission of documents. (Refer Trade Circular No. 4T of 2015 dated 9th March 2015, 5T of 2015 dated 6th May 2015, 7T of 2015 dated 19-5-2015 and 4T of 2016 dated 5-2-2016).

Where a person liable for registration/enrolment has wilfully failed to apply for such certificate within required time, the prescribed authority may, after a reasonable opportunity of hearing, impose penalty @ ₹ 5 (registration)/₹ 2 (enrolment) per day of delay. (However, it may be noted that L.A. Bill No, XIII of 2016 (introduced in Maharashtra Legislative Assembly on 7th April 2016 yet to be passed) provides that where an application for ‘Enrolment’ is filed between 1st April 2016 and 30th September 2016, or pending for approval as on 1st April 2016, liability to pay tax, u/s. 3 of the Act, for the period for which he has remained unenrolled shall not be for any period prior to 1st April 2013.) RETURNS Every registered employer shall furnish a return in Form III-B (electronic return). Non-filing of return, in time, may attract penalty.